Market round-up: Bitcoin rebounds, Silver hits ATH, Dollar slips

- Home

- Market Analysis

- Market round-up: Bitcoin rebounds, Silver hits ATH, Dollar slips

- Fed cut bets keep equity markets buoyed

- Easing geopolitical risk helps risk-on mood

- Bitcoin rebounds above $90k on positive industry-specific news

- Silver touches all-time amid weak USD and bets around tight supply

- FXTM USDInd hits bearish price target at 99.00.

It was a mostly positive week for markets as easing geopolitical risk and Fed cut bets supported risk assets.

Global equities are in the black while Bitcoin surged back above $90,000 thanks to Fed cut bets and positive industry-specific headlines.

In the commodity space, silver punched above $58.90 amid a broadly weaker dollar and concerns over tight supply.

As discussed in our week ahead, the USD remains under pressure with FXTM’s USDInd closing below 99.00 for the first time since late October.

Here is what you need to know:

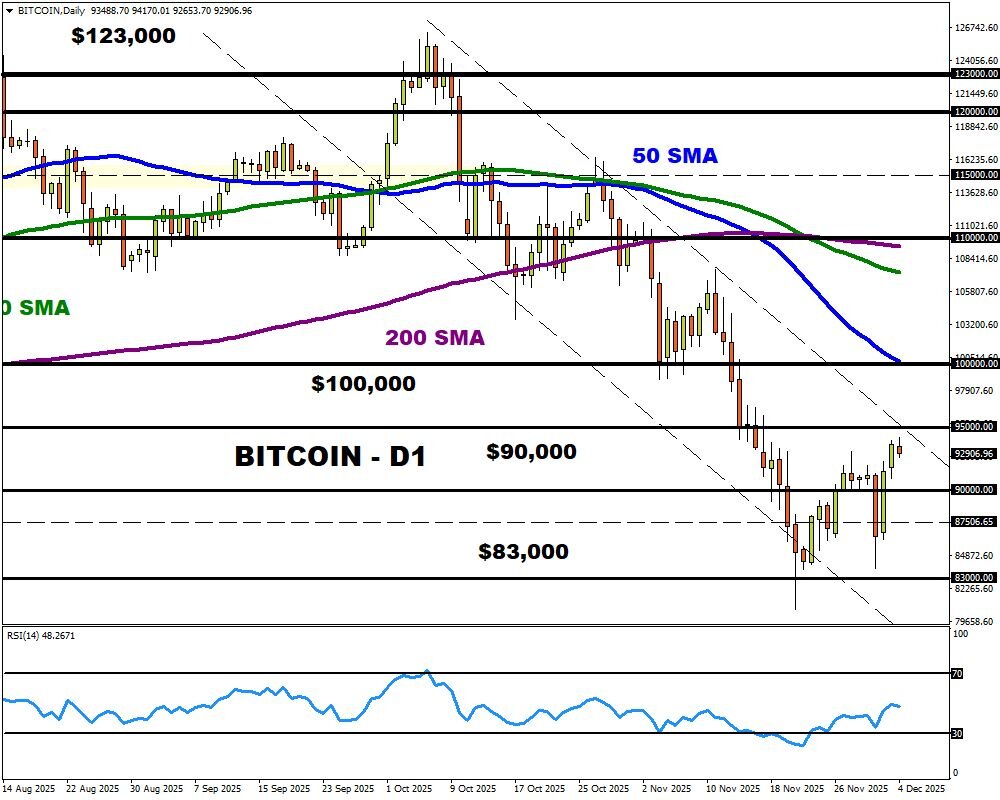

Bitcoin bulls fight back

Bitcoin rebounded back above $90,000 earlier this week, clawing back losses that erased nearly $1 billion in fresh leveraged bets.

Growing bets around lower US interest rates and comments by both the SEC and Vanguard injected bulls with fresh inspiration.

The SEC plans to unveil the measures behind an “innovation exemption” for digital asset companies while Vanguard group has decided to allow ETFs that hold cryptos to be traded on its platform.

Despite the rebound, it may be too early for bulls to celebrate as Bitcoin needs to push back above the psychological $100,000 level.

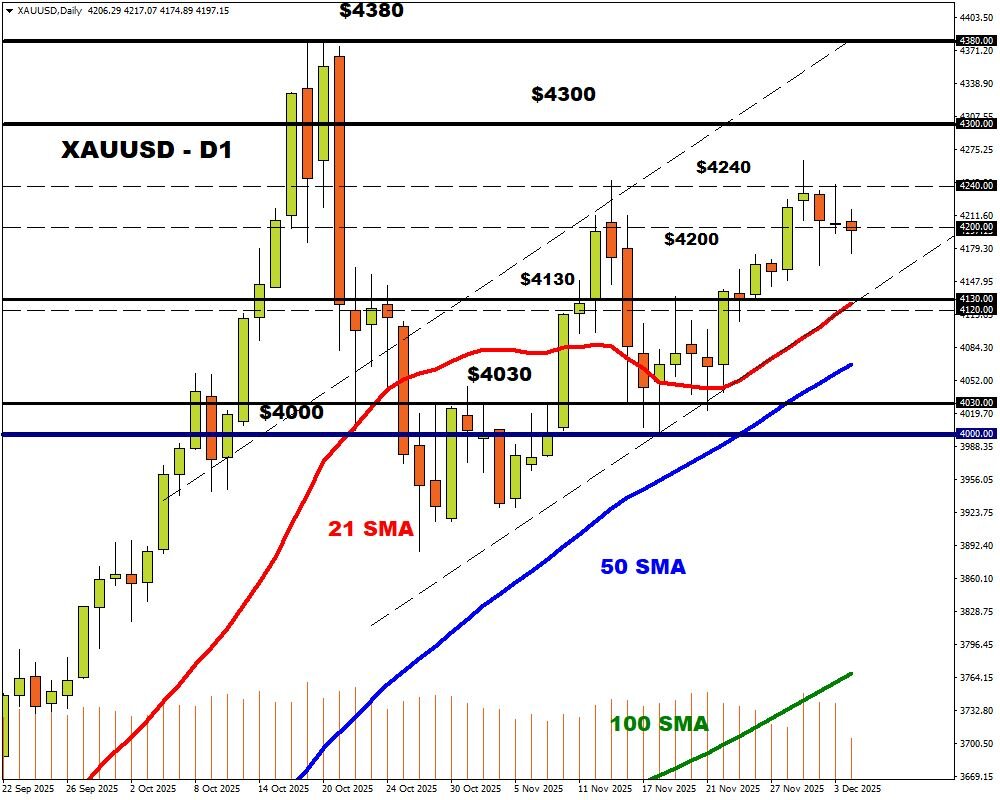

Silver gains over 100% YTD, Gold rangebound

Silver surged to a fresh record high on Tuesday before prices later slipped as traders took profit.

Nevertheless, the precious metal remains firmly bullish thanks to bets around lower US interest rates and speculative wagers around supply tightness. A weaker dollar has also fuelled the upside with silver boasting year-to-date gains of roughly 100%.

Looking ahead, traders will be closely watching for a potential tariff on silver in the US after the metal was added to the US Geological Survey’s critical mineral list.

It has been a choppy week for gold with prices trading around the $4200 level. Gold remains bullish but the metal seems to be waiting for a fresh catalyst.

Dollar stumbles into December

As discussed in our week ahead, the dollar pain has extended into December thanks to growing bets around lower US rates.

Given how the dovish-leaning Kevin Hasset is seen as Trump's chosen successor for Jerome Powell, this has added to the downside as traders priced further cuts for 2026.

Looking at the charts, FXTM’s USDInd closed below our first bearish price target at 99.00. The next key level of interest can be found at the 100-day SMA and 98.00.