Week Ahead: dollar faces first key test

- Home

- Market Analysis

- Week Ahead: dollar faces first key test

- USDInd ends 2025 ↓ 9.4% lower, biggest drop since 2017

- December NFP report may shape Fed cut bets for Q1 2026

- Ongoing Ukraine peace talks = heightened volatility?

- Over past year NFP triggered moves of ↑ 0.6% & ↓ 0.4%

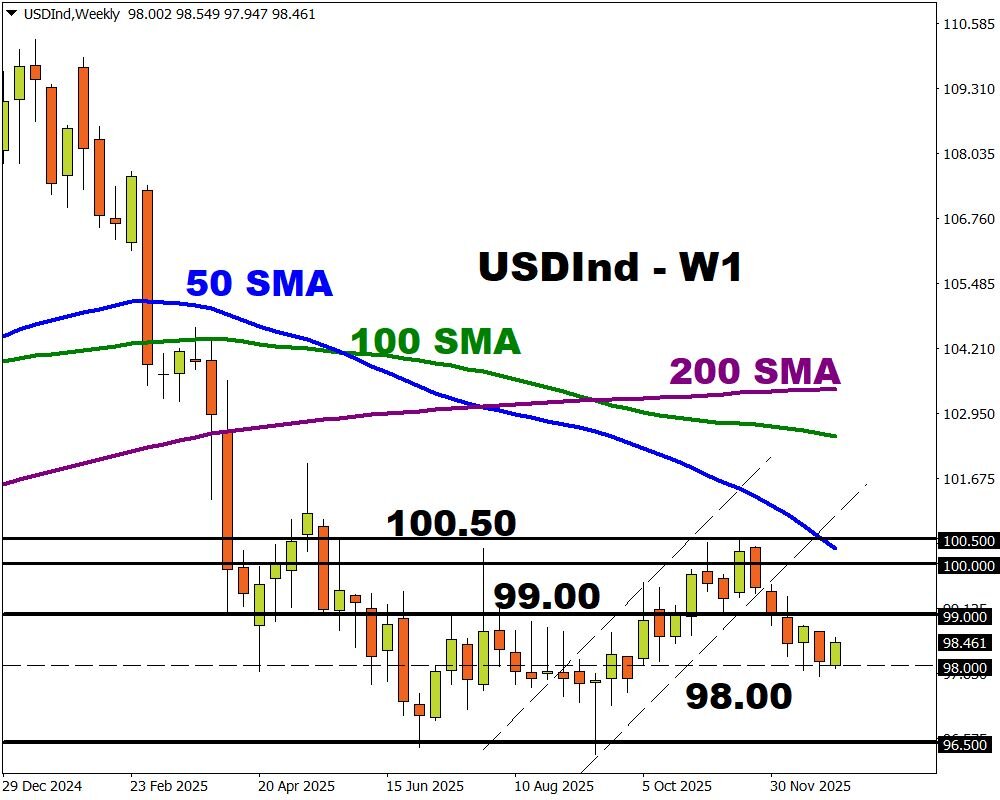

- Technical levels: 100.00, 99.00 & 98.00

The first full trading week of 2026 is packed with high-risk events!

Another round of Ukraine peace talks, a speech by Nvidia’s CEO and December’s US jobs report could spark fresh levels of volatility:

Sunday, 4th January

- OIL: OPEC+ meeting on production levels

Monday, 5th January

- CNY: China RatingDog services PMI

- JPY: Japan S&P Global manufacturing PMI

- USDInd: US ISM manufacturing, vehicle sales

- Nvidia CEO Jensen Huang speech on innovation & productivity

Tuesday, 6th January

- EUR: Eurozone HCOB services PMI

- FRA40: France CPI, HCOB services PMI

- GER40: Germany CPI, HCOB services PMI

- USDInd: Richmond Fed President Tom Barkin

Wednesday, 7th January

- AUD: Australia building approvals, CPI

- EUR: Eurozone CPI

- GER40: Germany unemployment

- USDInd: ISM services index, ADP employment change, JOLTS job openings, Fed Michelle Bowman speech

Thursday, 8th January

- AUD: Australia trade

- EUR: ECB publishes 1-year and 3-year CPI expectations

- EU50: Eurozone PPI, consumer confidence, economic confidence, unemployment

- GER40: Germany factory orders

- USDInd: US wholesale inventories, initial jobless claims, trade

Friday, 9th January

- CAD: Canada unemployment

- CNY: China PPI, CPI

- SP35: Spain industrial production

- EUR: Eurozone retail sales

- USDInd: US unemployment, nonfarm payrolls, University of Michigan consumer sentiment, housing starts

The spotlight shines on FXTM’s USDInd which ended last year 9.4% lower, its biggest drop in eight years.

Note: The USD Index tracks how the dollar is performing against a basket of six different G10 currencies, including the Euro, British Pound, Japanese Yen, and Canadian dollar.

2025 was rough and rocky for the dollar thanks to worries about the US fiscal deficit, while Trump’s global trade war and lower US interest rates fuelled the downside.

With the USD entering 2026 on a shaky note, could more pain be on the horizon?

Here are three factors to watch out for:

1) December NFP – Friday 9th January

Markets expect the US economy to have created only 55,000 jobs in December while the unemployment rate is expected to drop to 4.5% from 4.6% in the previous month. The low numbers may be a result of the government shutdown as the negative knock-on effects hit labour markets.

- A stronger-than-expected US jobs report could cool rate cut bets, boosting the USDInd higher as a result.

- However, further evidence of a cooling US jobs market could reinforce expectations around lower US rates – pulling the USDInd lower.

USDInd is forecast to move 0.6% up or 0.4% down in a 6-hour window after the US NFP report.

Note: Before the key US NFP report, the dollar is likely to be rocked by Fed speeches and other key data including ISM Manufacturing, ADP employment and initial jobless claims.

Traders are currently pricing in a 47% chance that the Fed cuts interest rates by March 2026.

2) Ongoing Ukraine peace talks

According to Ukrainian President Volodymyr Zelensky, the peace agreement to end the war with Russia is “90% ready”.

However, recent drone strikes in Russia have rekindled tensions between the two nations despite diplomats expressing optimism over peace talks.

- Should tensions intensify, this may weaken the Euro and spark fresh risk aversion – boosting the USDInd as a result.

- Any signs of cooling tensions could boost the Euro and support overall risk sentiment – weighing on the USDInd.

Note: The Euro accounts for almost 60% of the USDInd weight. A weaker euro tends to push the index higher and vice versa.

3) Technical forces

FXTM’s USDInd remains under pressure on the daily charts.

- A solid breakout and daily close above the 200-day SMA at 99.00 could trigger an incline toward 100-day SMA.

- Should prices break below 98.00, bears could be encouraged to hit 97.20 and 96.50.