Week Ahead: Fed showdown to set market tone

- Home

- Market Analysis

- Week Ahead: Fed showdown to set market tone

- Fed expected to cut rates for third time in 2025

- Updated dot plot and economic projections in focus

- Trader’s pricing 27% chance of another cut by January 2026

- RUS2000: Fed decision forecasted to trigger moves of ↑ 1.8% & ↓ 2.5%

- XAGUSD & Bitcoin to see fresh volatility?

The Fed’s decision on December 10th could be the biggest event in Q4!

Such an event is likely to trigger fresh opportunities across markets.

To be clear, US rates are expected to be cut for the third time this year but the outlook for 2026 is harder to determine.

Considering the many variables at play, anything is on the table…

Before we take a deep dive, here is a calendar of events for the week ahead:

Monday, 8th December

- CNY: China Balance of Trade (Nov)

- EUR: Germany Industrial Production (Oct)

- JPY: Japan GDP (Q3 final)

- CHF: Swiss Consumer Confidence (Nov)

Tuesday, 9th December

- GBP: BRC Retail Sales Monitor (Nov)

- AUD: RBA Interest Rate Decision; NAB Business Confidence (Nov)

- EUR: Germany Balance of Trade (Oct)

- USD: US JOLTs Job Openings (Sep & Oct); ADP Employment Change Weekly; Nonfarm productivity (Q3)

- WTI: API Crude Oil Stocks Change (w/e Dec 5)

Wednesday, 10th December

- CNY: China Inflation Rate (Nov); PPI (Nov)

- USD: Fed Interest Rate Decision; FOMC Economic Projections

- CAD: BoC Interest Rate Decision

- SPN35: Spain Consumer Confidence (Nov)

- WTI: US EIA Crude Oil Stocks Change (w/e Dec 5)

Thursday, 11th December

- GBP: RICS House Price Balance (Nov)

- CHF: SNB Interest Rate Decision

- USD: US Balance of Trade (Sep); Initial Jobless Claims (w/e Dec 6); PPI (Oct & Nov)

- NZD: New Zealand Business PMI (Nov)

- Brent: OPEC Monthly Report

Friday, 12th December

- GBP: UK GDP (Oct); Industrial Production (Oct); Manufacturing Production (Oct)

- USD: Fed Goolsbee Speech

Why is the December Fed meeting a big deal?

Missing economic data caused by the government shutdown and a deeply divided committee have left most scratching their heads over what to expect in 2026.

The absence of October’s NFP report and the latest CPI will force officials to decide based on incomplete information, at a time when the FOMC is more divided than in recent years.

Amidst the uncertainty, the Fed also publishes its updated economic projections and dot plot which may set the tone for policy in 2026.

Market expectations…

Traders are pricing in a 98% probability of a rate cut in December and expecting up to four rate cuts in 2026.

But these expectations may be heavily influenced by Fed Chair Powell’s press conference and the updated dot plot.

Will the dot plot tilt more in favour of hawks or doves? Whatever the outcome, it could rock financial markets.

Potential market impact…

Dovish tilt: supports risk assets (US equities), softens USD, lowers yields; bullish for gold/silver and Bitcoin.

Hawkish tilt: pressures equities, boosts USD, lifts yields; headwind for precious metals and cryptos.

Here is how these assets are forecasted to react in a 6-hour period after the Fed decision.

Source: Bloomberg.

- USDInd: ↑ 0.6 % or ↓ 0.2%

- NAS100: ↑ 1.6 % or ↓ 1.5%

- US500: ↑ 1.3 % or ↓ 1.3%

- XAUUSD: ↑ 0.3 % or ↓ 1.0%

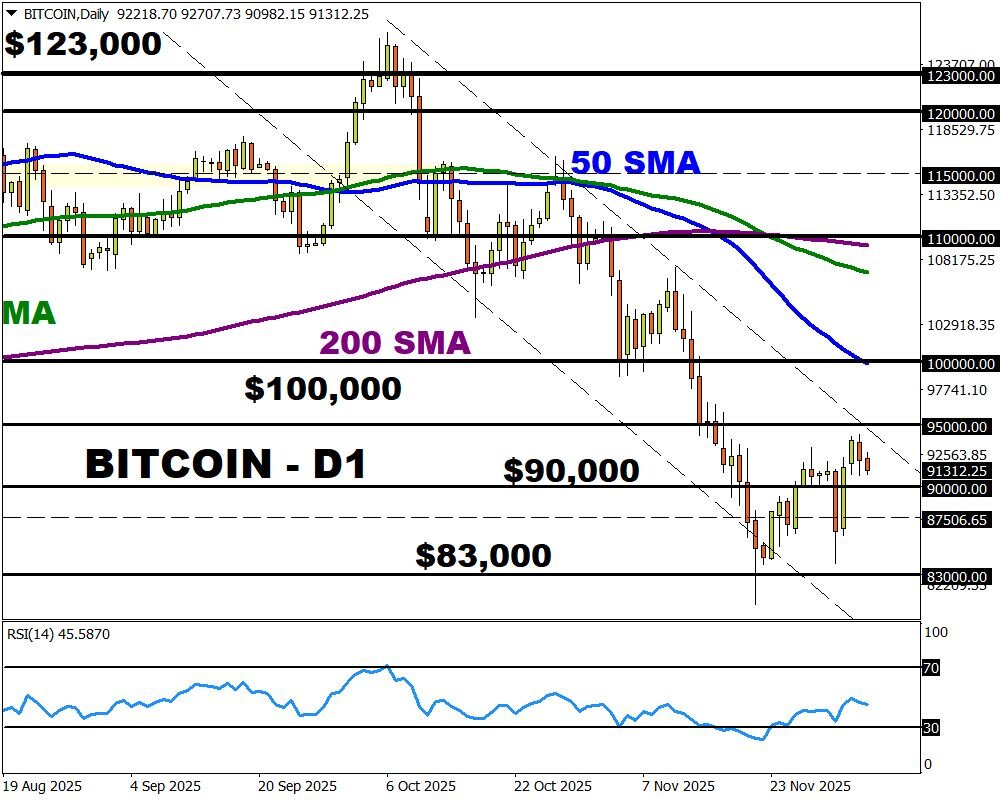

- BITCOIN: ↑ 2.0 % or ↓ 1.8%

- RUS2000: ↑ 1.8 % or ↓ 2.5%

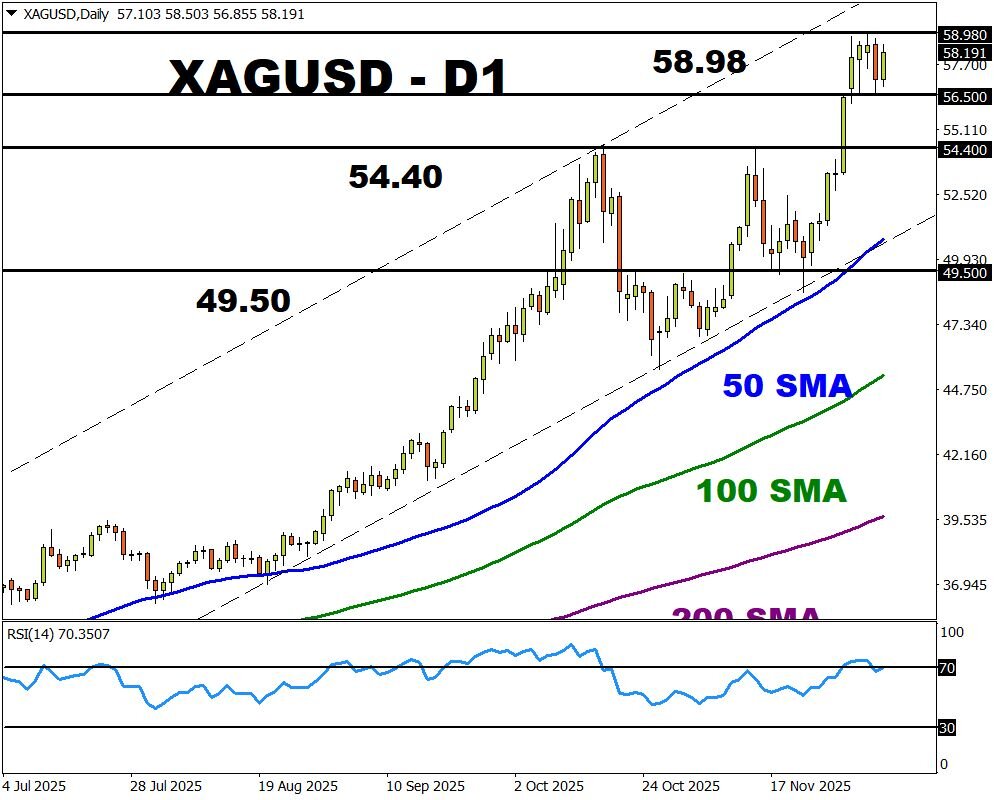

- XAGUSD: ↑ 0.5 % or ↓ 1.4%

Looking at the charts, RUS2000, BITCOIN and XAGUSD could be set for significant price swings. Key price levels have been identified on the charts.

RUS2000

FXTM’s RUS2000 tracks the smallest 2000 publicly listed US companies that are more reflective of true economic conditions.

It has gained roughly 13% year-to-date, trading roughly 1% away from its all-time high.

Key levels of interest can be found at 2547.6, 2500. and 2465.0.

BITCOIN

Bitcoin is back above $90,000 but bulls need to take out the psychological $100,000 to regain back control.

As highlighted earlier, a dovish tilt may boost prices higher while a hawkish tilt may spark a selloff.

XAGUSD

Silver is up almost 100% year-to-date, hitting an all-time high earlier in the week.

If the Fed signals further rate cuts in 2026, this could fuel the rally – opening a path to fresh highs.

Key levels can be found at $58.90, $54.40 and $49.50.