EURGBP braced for BoE/ECB combo, US CPI in focus

- Home

- Market Analysis

- EURGBP braced for BoE/ECB combo, US CPI in focus

- ECB expected to leave rates unchanged in December

- BoE seen cutting rates by 25 basis points

- Hawkish ECB + Dovish BoE = bullish EURGBP

- Incoming US CPI report may rock US equities

- US30 = technicals levels - 48,500 and 50-day SMA

A super central bank combo featuring the Bank of England (BoE) and European Central Bank (ECB) could shake up the EURGBP today…

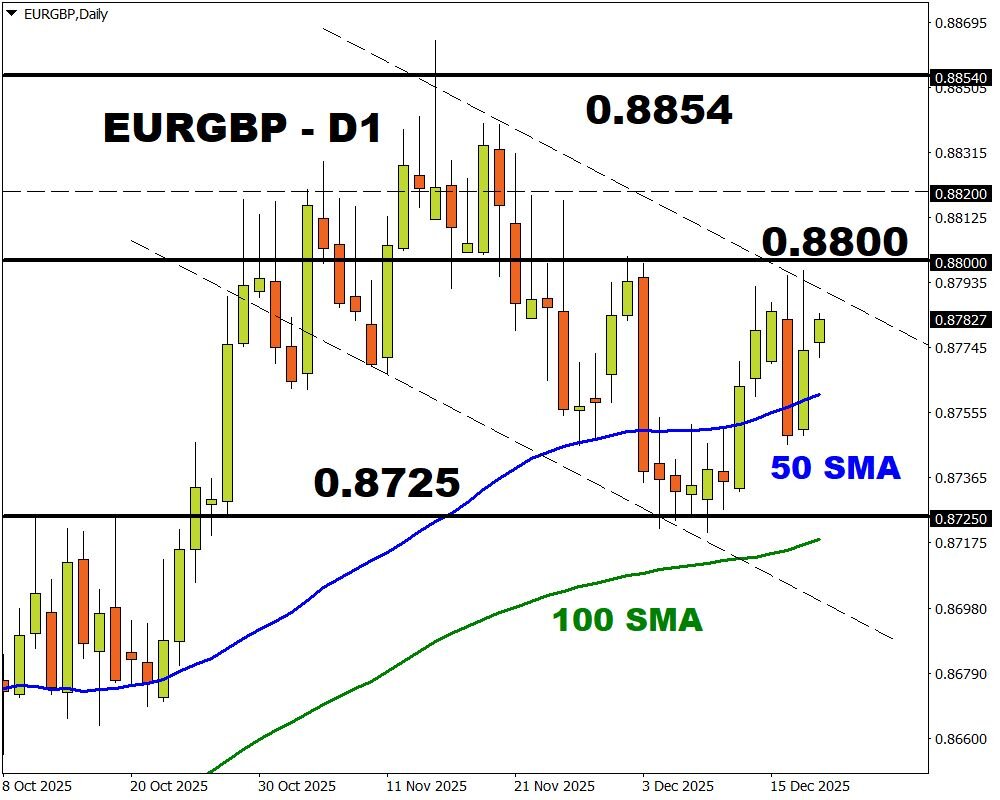

The minor currency pair has gained 6% YTD with prices trapped within a range with resistance at 0.8800 and support at 0.8750.

Since late 2025, there has been a growing policy divergence between the BoE and ECB amid differing inflation and growth outlooks.

· The BoE is set to CUT rates today and at least 2 more times in 2026.

· The ECB is set to HOLD rates today and leave rates unchanged in 2026.

This hawkish + dovish combo could mean the EURGBP rallies in the longer term.

Note: Strong EUR + Weak GBP = BULLISH for EURGBP.

Thursday 18th December

· BoE December rate decision – (12:00 PM GMT)

BoE expected to cut interest rates by 25 basis points to 3.75%.

EURGBP is forecasted to move 0.3% up or 0.5% down in a 6-hour window after BoE rate decision.

· ECB December rate decision – (13:15 PM GMT)

ECB expected to leave interest rates unchanged.

EURGBP is forecasted to move 0.2% up or 0.3% down in a 6-hour window after BoE rate decision.

POTENTIAL SCENARIOS:

BULLISH – A solid daily close above 0.8800 may open a path toward 0.8820 and 0.8854 - the upper limit of Bloomberg’s FX model.

BEARISH – Weakness below the 50-day SMA may trigger a decline toward 0.8725 and 0.8722 the lower limit of Bloomberg’s FX model.

US30: WAITS ON KEY US CPI

FXTM’s US30 has slipped this week, dropping roughly 2% as investors sold tech shares amid concerns over their sky-high valuations.

WHAT COULD MOVE THE US30?

All eyes will be on the US CPI this afternoon.

Thursday 18th December

- US November CPI – (13:30 PM GMT)

November’s consumer price index report will be the first one since the U.S. government shutdown ended last month.

Note: US CPI is expected to have risen 3.1% year-on-year in November, which would be the largest gain since May 2024.

US30 is forecasted to move 1.2% up or 0.9% down in a 6-hour window after the US CPI is published.

Traders are currently pricing in a 26% probability that the Fed cuts rates in January 2026.

POTENTIAL SCENARIOS:

BULLISH – A softer-than-expected CPI report may push the US30 back above 48,500 and the all-time high at 48,963.

BEARISH – A hotter-than-expected CPI report could drag the US30 below the 50-day SMA and 47,000.