Geopolitics, Commodities & US NFP in focus

- Home

- Market Analysis

- Geopolitics, Commodities & US NFP in focus

- Equity markets unfazed by geopolitical risk

- Gold & Silver jump on cautious mood before stabilizing

- Oil benchmarks supported by geopolitical risk premiums

- US economy expected to have created 65,000 jobs in December

- Weak print may boost Fed cut bets for Q1 2026

Global equities extended gains on Tuesday, rising to yet fresh records as investors seemed unfazed by tensions in Venezuela.

Over the weekend, the US carried out large-scale strikes against the country, capturing its president, who is expected to make his first appearance today in a US federal court.

Despite the heightened geopolitical risk and global ramifications, equities drew support from tech strength and prospects around lower interest rates.

Nevertheless, there remains an air of caution as investors not only monitor the Venezuela developments but also Ukraine.

In the commodity space, oil benchmarks closed almost 2% higher in the previous session as the weekend strikes pumped some geopolitical risk premiums into prices. However, prices later stabilized amid ongoing concerns over a global glut.

Gold also popped higher on Monday, closing 2.7% higher amid a weaker dollar and tensions in Venezuela. The precious metal gained almost 65% in 2025 thanks to central bank purchases, ETF inflows, lower US interest rates and a weaker dollar.

Prices remain fundamentally bullish in the long term, but we may see some near-term consolidation as investors wait for key US data.

The main attraction this week will be December’s NFP report on Friday.

Markets expect the US economy to have created only 65,000 jobs in the final month of 2025 while the unemployment rate is expected to drop to 4.5% from 4.6% in the previous month.

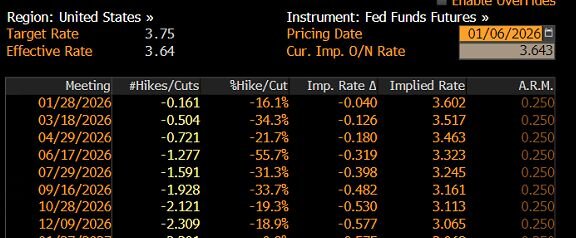

Traders are currently pricing in at least two Fed rate cuts in 2026 with the odds of a third cut by December around 30%.

- A stronger-than-expected US jobs report may shave these odds, supporting the dollar at the expense of gold prices.

- However, further evidence of a cooling US jobs market could bolster expectations around lower rates – boosting gold as the dollar weakens.