Gold shaky ahead of US data dump

- Home

- Market Analysis

- Gold shaky ahead of US data dump

- Gold ↑ 64% year-to-date

- Precious metal seen only one negative month in 2025

- US NFP + CPI = volatility?

- XAUUSD forecasted to move ↑ 0.8% or ↓ 1.0% post NFP

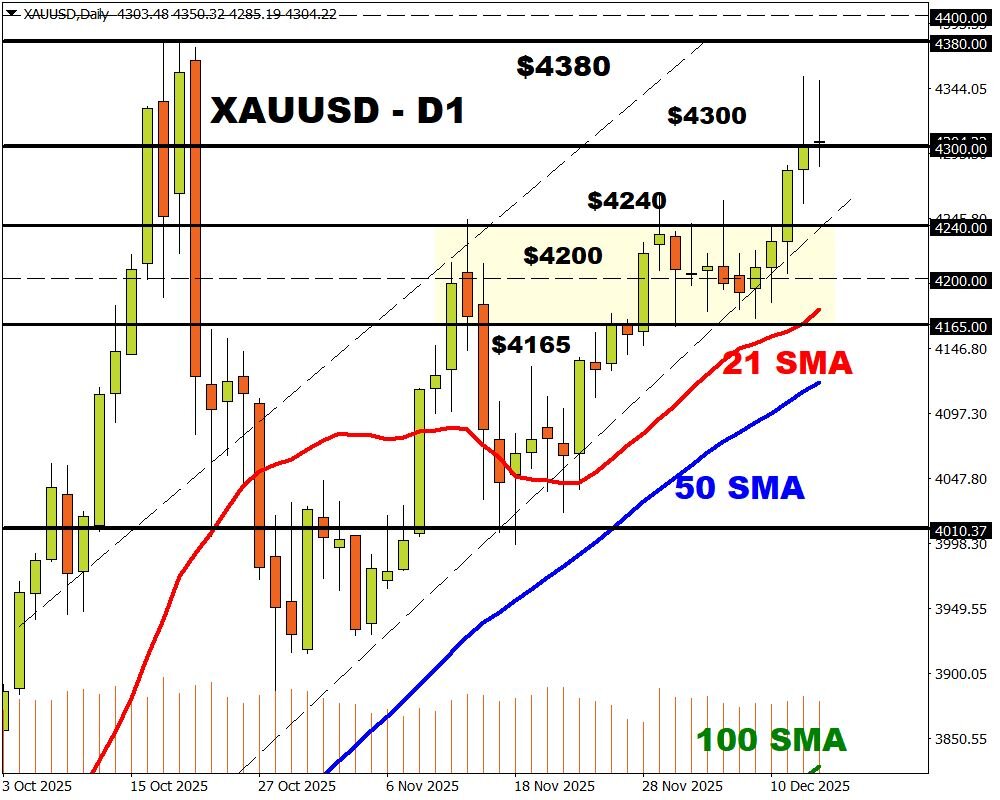

- Technical levels - $4380, $4300 and $4240

Gold jumped over 1% on Monday before giving back gains as investors took profit ahead of key US data that will shape interest rate expectations.

Last Friday, prices hit a seven-week high, trading less than 1% from all-time highs before slipping on hawkish Fed comments.

Over the past few weeks, gold has displayed a high sensitivity to Fed rate cut expectations with the incoming data dump potentially sparking heightened levels of volatility.

Tuesday 16th December

- US NFP (Oct/Nov) – (13:30 PM GMT)

XAUUSD is forecasted to move 0.8% up or 1.3% down in a 6-hour window after the NFP report.

- US October Retail sales – (13:30 PM GMT)

XAUUSD is forecasted to move 0.8% up or 0.6% down in a 6-hour window after US retail sales report.

- S&P Global PMIs – (14:45 PM GMT)

XAUUSD is forecasted to move 0.4% up or 0.4% down in a 6-hour window after US Global PMIs

Thursday 18th December

- US Inflation Rate (Oct/Nov) – (13:30 PM GMT)

XAUUSD is forecasted to move 1.0% up or 0.1% down in a 6-hour window after US CPI report

Note: Traders are currently pricing in a 57% chance of a Fed cut by March 2026

Any major shifts to these bets may impact gold’s outlook for the rest of 2025.

POTENTIAL SCENARIOS:

BULLISH – A solid daily close above $4300 may open a path toward the all-time high a $4380.50, $4400 and $4415.47 - the upper limit of Bloomberg’s FX model.

BEARISH – Weakness below $4300 could see prices decline toward $4240, $4200 and $4190.97 the lower limit of Bloomberg’s FX model.