Gold shines on geopolitics and worries over Fed independence

- Home

- Market Analysis

- Gold shines on geopolitics and worries over Fed independence

- Gepolitical tensions hijack market headlines

- Gold hits fresh records amid concerns over Fed independence

- Q4 earnings kick off on Tuesday, led by US banking giants

- US Supreme Court ruling on Trump's tariffs on Wednesday

- US CPI data could shape Fed cut bets for Q1

Trump weaponized tariffs in 2025.

Could military action be his new play for 2026?

Heavy threats have been dished out to countries with the capture of Venezuela’s President on 3rd January putting the world on edge.

Trump has:

- Ramped up threats to acquire Greenland

- Placed a target on Cuba

- Threatened military action in Colombia

- Spoken about Mexico

- Made a clear threat against Iran

- Threatened more bombings in Nigeria

- In December, launched airstrikes across Syria

These negative developments are occurring alongside the Russia/Ukraine conflict and rising tensions between China/Taiwan.

Note: Just over the weekend, Iran threatened the US against any intervention over domestic protests.

Geopolitical flashpoints are likely to spark risk aversion, supporting safe-haven assets like gold.

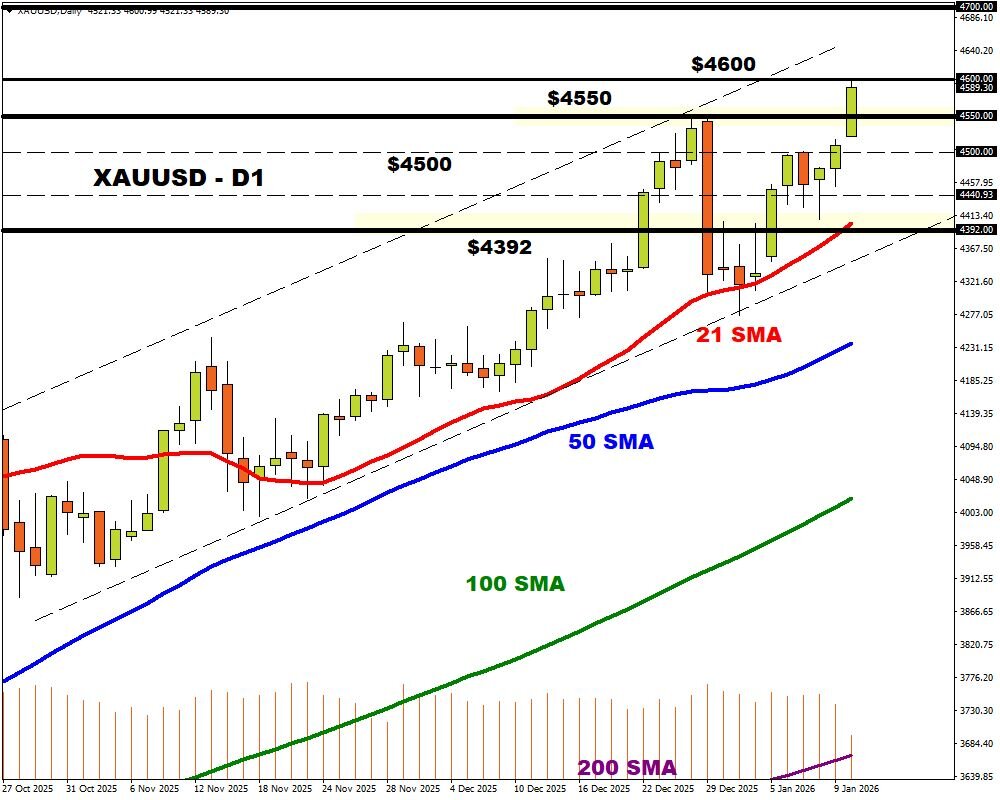

Speaking of gold, it has kicked off the new week, hitting fresh-all time highs – pushing 2026 gains to nearly 6%.

Prices jumped after the US Justice Department threatened the Fed with a criminal indictment, reviving concerns over its independence.

WHAT COULD MOVE XAUUSD THIS WEEK?

Geopolitics, the Supreme Court ruling and key US data may influence the outlook for gold.

Tuesday 13th January

- US December CPI report – (13:30 PM GMT)

XAUUSD is forecasted to move 1.0% up or 0.2% down in a 6-hour window after the US CPI report.

Wednesday 14th January

- US retail sales – (13:30 PM GMT)

XAUUSD is forecasted to move 0.8% up or 0.6% down in a 6-hour window after the US CPI report.

- US Supreme Court Ruling

*The Court may rule on the legality of President Trump's "Liberation Day" tariffs, determining if their imposition was lawful and whether importers are owed refunds*

POTENTIAL SCENARIOS:

BULLISH – A solid daily close above $4600 may trigger an incline toward $4650 and $4706.07 the upper bound of Bloomberg FX model.

BEARISH – Weakness below $4600 could see prices decline toward $4500 and $4436.90 the lower bound of Bloomberg’s FX model.