Markets gripped by geopolitics, uncertainty & Trump

- Home

- Market Analysis

- Markets gripped by geopolitics, uncertainty & Trump

- Risk-heavy week leaves investors on edge

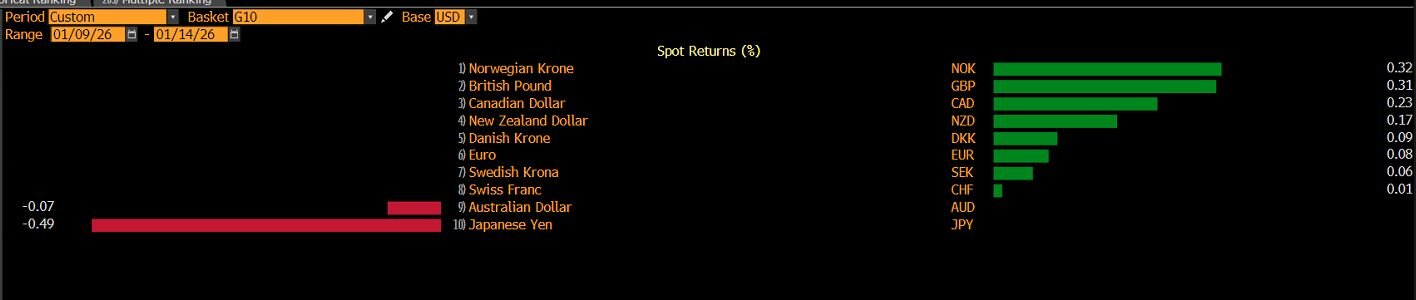

- Yen is the worst-performing G10 currency week-to-date

- US Supreme Court scheduled to rule on Trump's tariffs

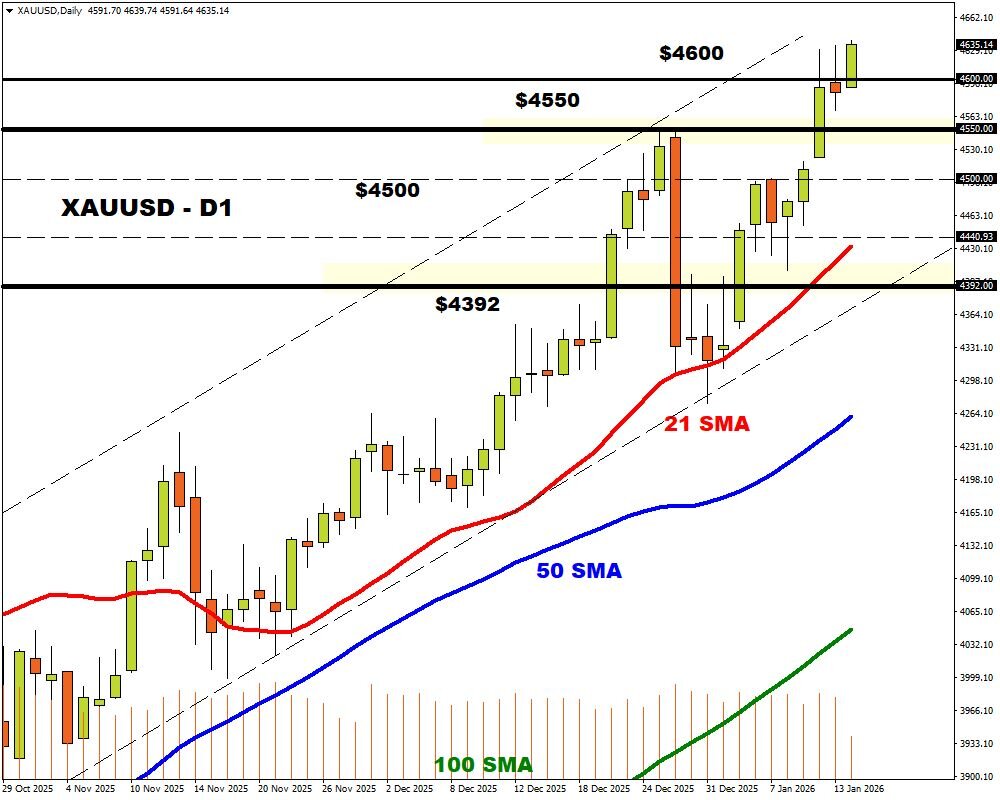

- Gold & Silver rally to fresh all-time highs

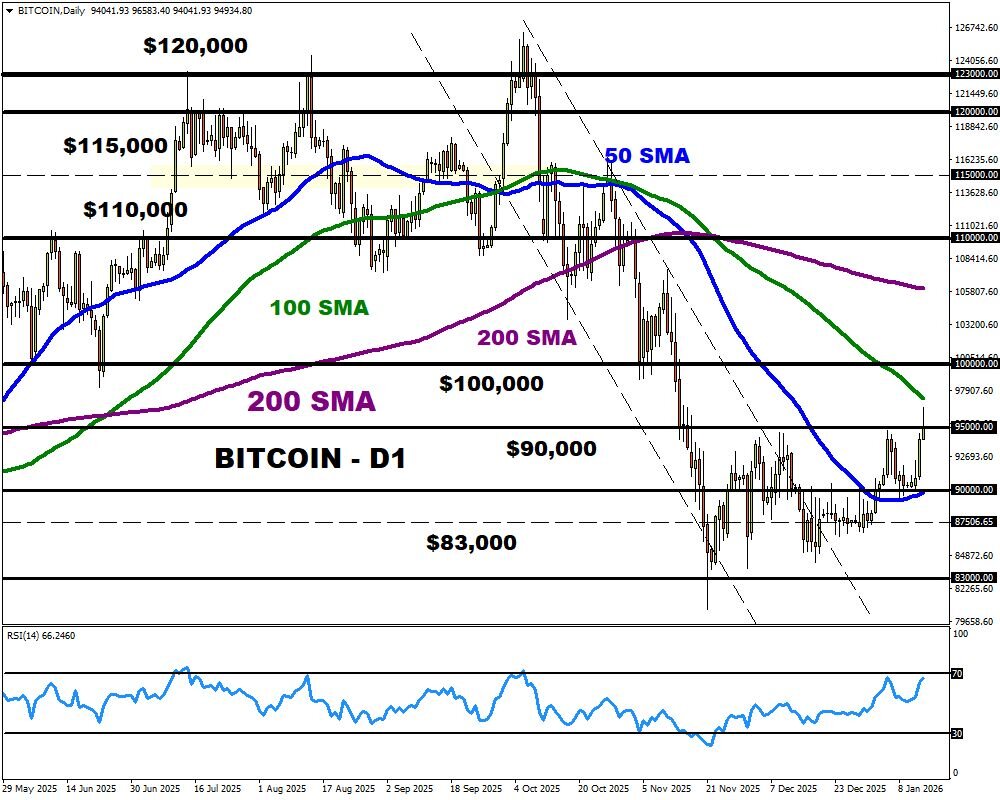

- Bitcoin hits highest level in two-months above $96,000

It’s been a tense week defined by geopolitics, concerns over the Fed’s independence, and anticipation ahead of a US Supreme Court ruling on Trump’s tariffs.

This messy mashup of high-risk events has created a smog of uncertainty, with investors adopting a defensive approach toward risk.

Nevertheless, European shares clawed back some losses this morning after a modest dip in the previous session, but US equity futures are pointing to a shaky open.

Geopolitical flashpoints across the globe, concerning Iran and Ukraine, have dominated headlines, boosting the appetite for safe-haven assets. On top of this, Trump recently threatened 25% tariffs on countries trading with Iran, and as expected, China has threatened to retaliate.

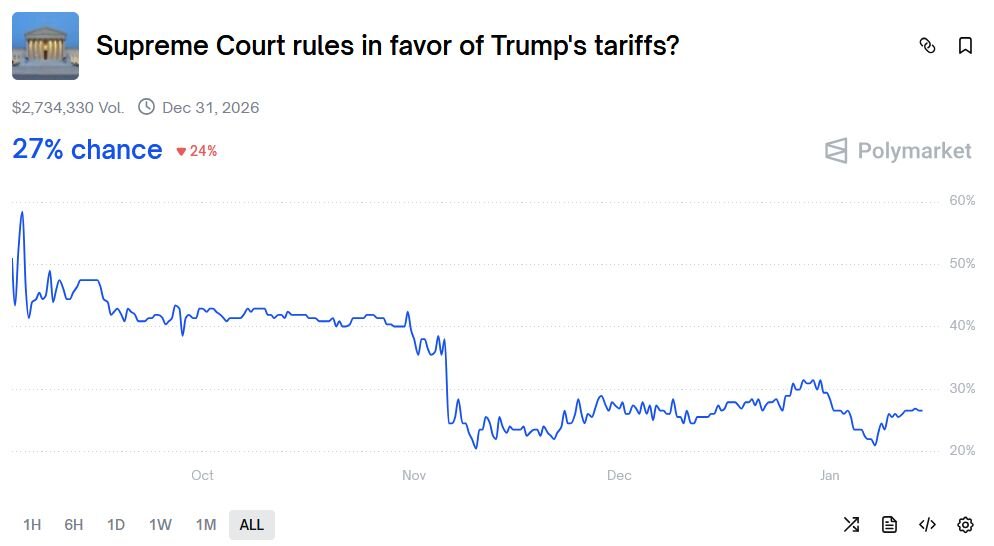

On the trade front, the US Supreme Court is scheduled to rule on the legality of Trump’s tariffs. Prediction markets are giving the administration only a 30% chance of prevailing.

(Source Polymarkets)

Equity markets may experience a relief rally if the court strikes down the tariffs, but gains may be capped by trade policy uncertainty.

In the FX space, the Yen is the worst-performing G10 currency this week amid rising political uncertainty in Japan. The USDJPY is slowly approaching the danger zone, with speculation growing over a potential intervention. With the Fed expected to cut rates twice in 2026 and the BoJ seen hiking twice, this divergence in monetary policy could signal a selloff down the road.

Looking at earnings, JPMorgan’s fourth-quarter results topped consensus on most measures. However, investment-banking fees dropped by 5%, missing the bank’s own guidance. In result, JPMorgan shares tanked over 4% - taking 2026 gains to negative 3.5%. This rocky start to earnings dragged the us equities lower, with the Dow Jones ending almost 1% lower.

Commodities have been a bright spot this week, with both gold and silver hitting fresh all-time highs. Silver has gained over 25% since the start of 2026, adding to the whopping 148% rally seen last year. Gold is lagging, rising 7% this month thanks to heightened geopolitical risk, fears over the Fed’s independence, and bets around lower US rates.

With silver hitting $91.55 this morning, could $100 be on the cards by the end of the month? Prices are trading less than 10% away from this level as of writing.

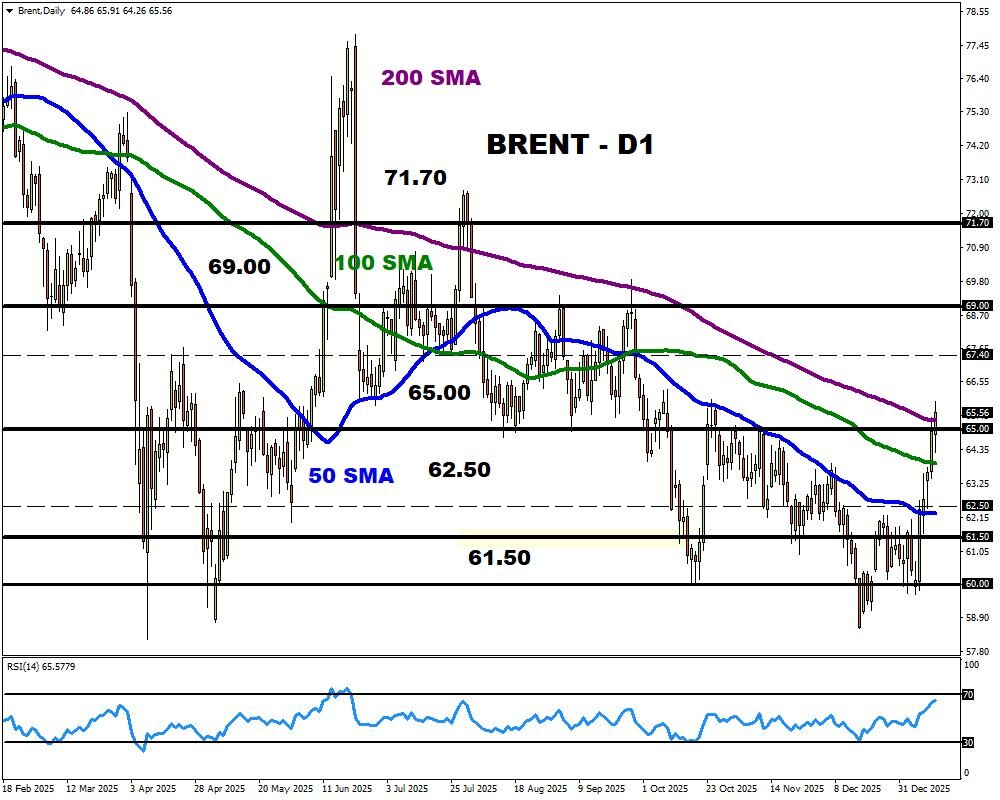

Oil prices slipped on Wednesday after seeing their biggest four-day rally in more than six months. The negative developments in Iran and possible intervention by the United States have fuelled concerns over supply disruptions impacting around 3.3 million bpd of the country’s output. While oil benchmarks are pushing higher, concerns over ongoing oversupply may limit upside gains.

In the crypto space, Bitcoin jumped to a two-month high as prices punched above $96,000. The “OG” crypto drew strength from the latest US inflation report, which rose less than expected, while concerns over the Fed’s independence offered further support. Bitcoin is up over 8% year-to-date, with the next bullish level of interest at $100,000.