Dollar steady ahead of U.S. JOLTS, Oil benchmarks sink

- Home

- Market Analysis

- Dollar steady ahead of U.S. JOLTS, Oil benchmarks sink

- Risk assets waver on geopolitical risk

- USDInd steady ahead of JOLT & Friday’s NFP

- Oil benchmarks ↓ 1% amid global glut fears

- Bitcoin hovers above $90,000

- Precious metals wait for fresh directional catalyst

A sense of caution gripped markets on Wednesday as investors monitored global geopolitical developments.

Equities were headed for their first negative day of 2026, while oil benchmarks slipped after Washington moved to reinforce greater control over Venezuela’s oil industry.

In the FX space, the dollar held steady while precious metals slipped ahead of key US data.

All eyes will be on the U.S. Jolts data on Wednesday and NFP report on Friday.

- Market Expectation: Job openings for November are forecast at 7.7 million, nearly unchanged from October

Surprise Potential:

- If openings are higher than expected this may reinforce hopes around a hot jobs markets. Rate cuts get pushed further out, likely pushing the USDInd higher.

- If openings are lower than expected- signals the labor market is softening. Rate-cut bets increase, likely pulling the USDInd lower.

Looking at the charts, the USDInd remains in a range with support at 98.00 and resistance at 99.00.

Brent wobbles above $60

Oil extended losses after Washington moved to reinforce more control over Venezuela’s oil industry.

Trump announced that the U.S. would take and sell 30 to 50 million barrels of "sanctioned oil" currently stuck in tankers and storage. This immediate supply increase weighed on the global commodity, already being pressured by oversupply fears.

Brent is down roughly 0.5% as of writing with support at $60. Weakness below this level may open a path toward $58.50.

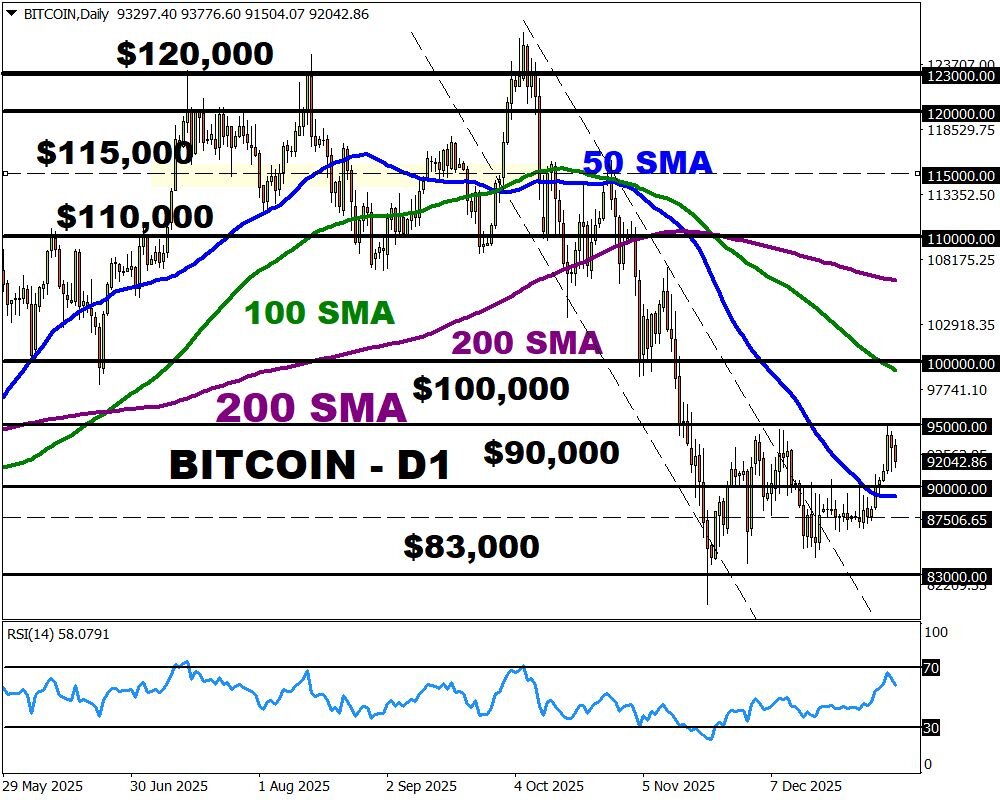

Bitcoin waits for fresh catalyst

The CMC Crypto Fear & Greed Index currently sits at 42 (Neutral), reflecting an improvement in sentiment versus recent weeks.

Historically, similar readings have coincided with periods of consolidation and medium-term stabilization.

A fresh directional catalyst may be needed to trigger the next big move.

Major crypto market developments:

Bitcoin has climbed to a three-week high despite the mounting political uncertainty after the US moved to oust Venezuela’s president.

These gains seem to be fuelled by crypto-native firms and an absence of selling by groups including Bitcoin miners and big investment funds.

Nevertheless, prices have been stuck in a tight trading range for weeks with Bitcoin ending 2025 over 6% lower – its first negative year since 2022. In the near term, the trend could be bullish given that investors pumped a whopping $471 million into the 12 US-listed Bitcoin ETFs on January 2, 2026.

Bullish Scenario: A solid daily close above $95,000 may open a path toward $100,000 and higher.

Bearish Scenario: Weakness below $90,000 could see a decline toward $87.500 and $83,000.