* Trading is risky. Your capital is at risk

Why trade Indices with FXTM?

Broad selection of global Indices

Faster execution for better price

Leverage up to 1:3000

Go long or short

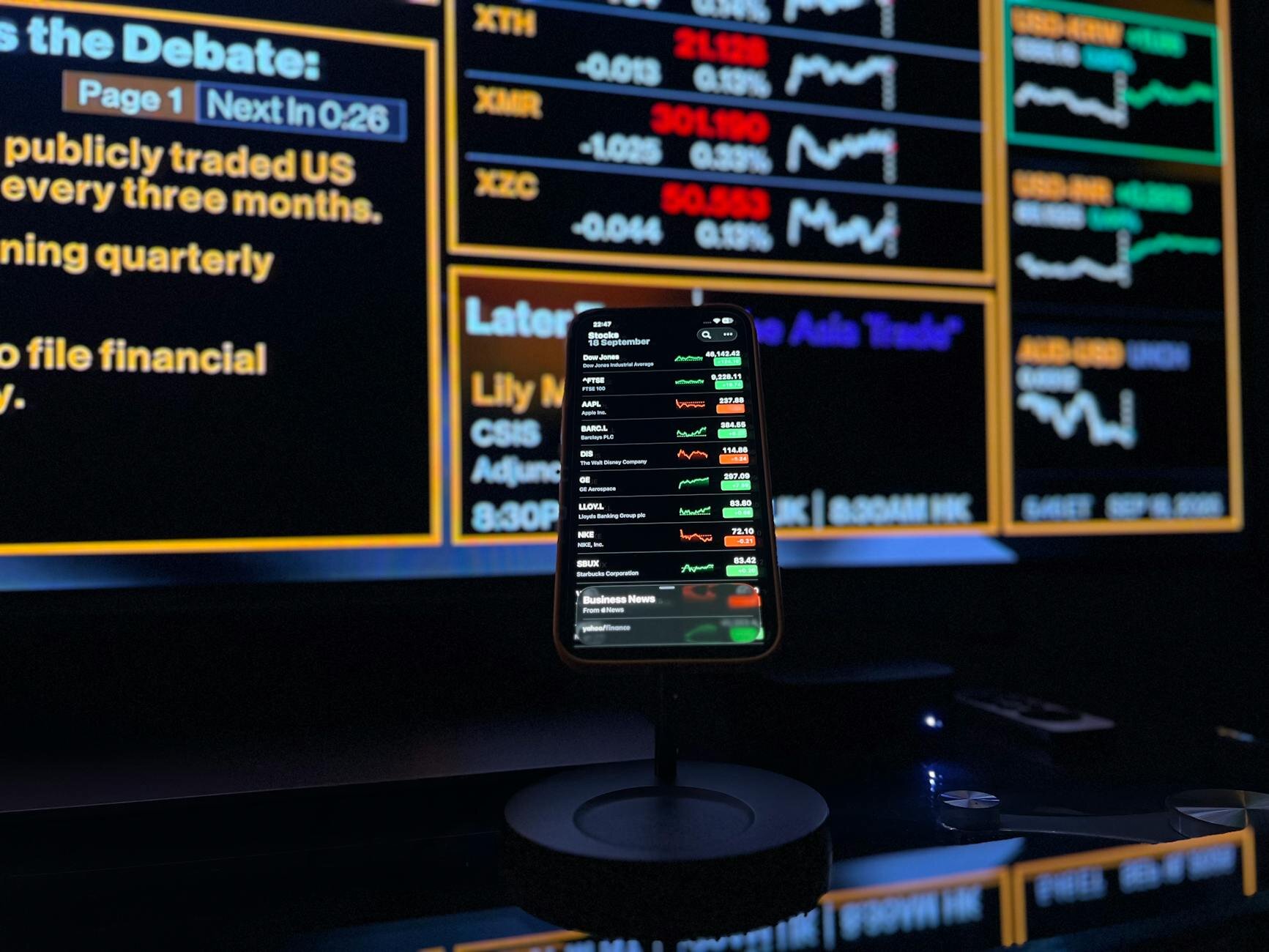

Tap into global Indices

Trade Indices from around the world

Take your position on leading Indices across the US, Europe and Asia.

An index is an instrument that tracks the price performance of a specific collection of stocks, based on predefined criteria. Think - the top 500 companies in the US.

Trade Indices with FXTM to gain exposure to an entire portfolio of stocks with a single trade.

- Trade Indices with Contracts for Difference (CFDs) for these great benefits: Go long or short to suit your trading strategy

- Track an economy or sector from a single position

- Maximise your potential profits with leverage

Get to know our top indices

Frequently asked questions

An index measures the collective price performance of a group of shares, usually from a particular country.

Indices are often used to track and compare the performance of stock markets.

The performance of each index is dictated by the performance of the underlying share prices that make up that index. An index is constructed and calculated independently, sometimes by a bank or by a specialist index provider like the FTSE Group.

The choice of companies included is determined by index calculation rules or by a committee. Not all indices use the same rules.

When you trade Indices, you own the asset itself. Trading Indices CFDs, on the other hand, allows you to speculate on price movements without ever owning the asset.

A key advantage of CFDs is that you can enter contracts for prices falling (going short), as well as rising (going long).

The most popular way to trade indices is via Contracts for Difference, or CFDs. By using a CFD for indices trading, traders can profit from prices whether they rise or fall.

Traders can accomplish this by either opening a short position (sell) or opening a long (or buy) position depending on whether they think the index will fall or rise, respectively.

You'll notice that our CFD indices markets have different names to the underlying indices themselves. This is because the actual stock indices are calculated, owned and trademarked by various organisations.

For example, the Dow Jones Industrial Average is owned by S&P Dow Jones Indices, while the German DAX is operated by Deutsche Börse. This means we can’t use their official names on our platform.

| Underlying index | FXTM’s market |

|---|---|

S&P 500 | US500 |

Nasdaq 100 | NAS100 |

FTSE 100 | UK100 |

Nikkei 225 | JP225 |